Wow, we officially made it through 2023. Guys, I’m so thankful for the moves we made last year and excited for what’s to come. Let’s do a EOY 2023 recap! Last year we lived in another state, with stagnant wages and rising taxes without increased value provided. We began the year by pulling the trigger and putting our house up for sale. If we didn’t move then, we never would. Why wait when the selling’s good?

2023 produced a marked shift away from the known and comfortable life we led with all it’s predictability and inevitability. Something that was much needed to break up the monotony we’d found ourselves stuck in. We wouldn’t have ever been able to achieve our combined life goals if we’d stayed from the sheer fact that the land we lived in was unaffordable, barren, and will not be hospitable to our goals. I.E. establishing a family run hard cider orchard. Apples and other cider fruits like pears or peached require a set amount of water and cold hours. Our old state doesn’t have the water, they’re fighting with other states over it and with global warming we’re seeing less and less cold hours. Even if the water issue was solved, give it 10 to 15 years, there won’t be enough “cold” to go around.

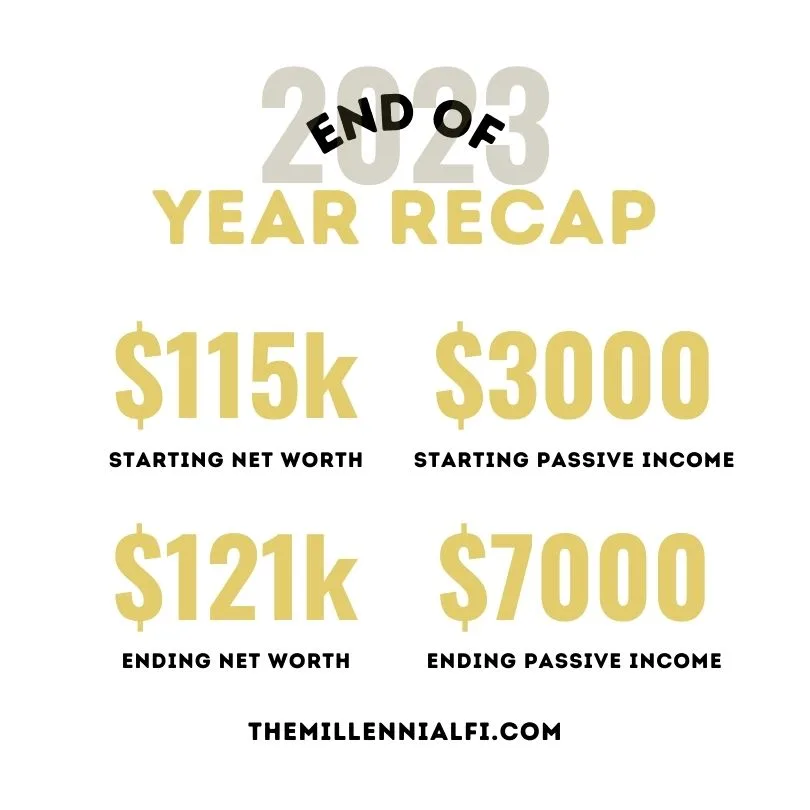

2023 also brought with it a change in investing mindset. While it would be nice to get a constant 30+% return as we’d seen in prior investing years and leverage our savings to buy real estate, after finally escaping the call center life, I don’t have it in me to deal with people. And renting is a “people” game. Therefore our strategy shifted to one where we minimize debt while maximizing returns. Instead of investing in real estate, we took a heavy stance in REITs (real estate investment trusts) and BDCs (business development companies). Essentially skyrocketing our dividend income by 133% without majorly increasing our base investments simply by reallocating under the new strategy.

As of the last trading day of the year, our portfolio is up 16% YTD with an estimated overall 8.2% yield when averaged across all investment sectors. That’s roughly 24.2% return assuming the market will perform the same or better next year. The goal being to live on the dividend income without having to “sell shares” to cash out when we eventually reach FIRE. While some FIRE participants don’t see the value in the power of dividends or keeping their shares, we do!

And yes, we’ll have to pay taxes on the dividend and interest income but it’s a small price to pay when we’ll be that much more financially secure and able to quit our jobs to spend time with our family and build our orchard business sustainably. It’ll just take time, as is, we’re about $25,000 in passive income away from one of us being able to “retire” permanently and are estimated to hit that in the next two to three years.

So how many trades did we make by EOY 2023 to make this happen? The answer is 444.

In 2024, our goal is to make less trades. Now that we’ve reallocated and adjusted our investment strategy, we won’t need to be so active in the market. The first 6 months of 2024 will have an estimated 0 trades executed outside of dividend reinvestment as we drop temporarily to one income. Once I return to work and ensure we’re not catabolizing our accounts, we can begin to trade again.

What were our top 5 industries? Finance, “other” meaning uncategorized, “tech, media, and telecom”, “energy & water”, and “consumer goods”. With the finance category being REITs and BDCs. We also opened positions in healthcare, hospitality, and “manufacturing and materials”.

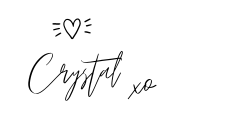

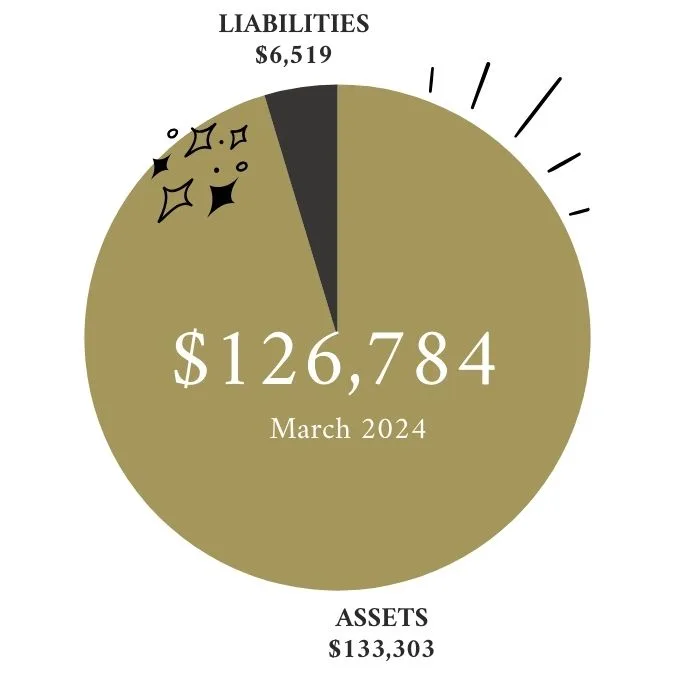

Our investing goal in 2024 is to maintain our assets and increase our net worth to 150k. We will also consider purchasing a house or land plus house depending on how the next six months go.

What are some things we can do to be more financially secure?

Easy, set up an IRA to rollover my 403b. This avoids paying taxes from “cashing out”, an action we always did prior to 2024 because we had not been financially secure enough to be able to keep the money in a retirement account. This account will be reinvested and will have an estimated 2k in annual dividend income that will be reinvested within it, essentially compounding the account passively to 2 Million. AKA coast FIRE and if done with our current strategy will gross about 200k in annual dividend income on it’s own. By the time we’re able to pull money penalty free, we would have already faced a massive income/taxes problem. Staying on course, we’d bring in over 3 million a year in annual dividends alone without the IRA or orchard income. This is not the type of problem or money we want or need so some choices will need to be made over the 30 year time horizon.

We will also be opening a custodial account to be handed over to our child when they reach 21 years of age. This will be semi-coast account, setting 5k aside in high yield REITs with additional $50 per month contribution to amass around 195k. By the end, the account will earn around 18k/year in annual dividends for our child, ensuring their financial ability to cover basic needs like rent so they don’t have to struggle with homelessness like we did.

Looking back at EOY 2023, we didn’t do so bad! What are some things you can do in 2024 to make your life financially easier in 2025?