To declutter finances, much like Marie Kondo’s decluttering method did for our homes, we must also look to apply similar methods to our financial life. Because let’s be real, most of Gen Y’s financial life is in the dog house. We’ve been hit with multiple economic disasters and still have a decent amount of earning years left to go. Couple that with sky-high tuition, house pricing, inflation, raising interest rates, and a society that expects us to be consumers versus savers and we don’t have much left to stand on.

2022 was notably a year that scared EVERYONE’s finances, not just Millennials. I speak with the public every day in my job and the number of people struggling – even before the pandemic, is soul-crushing. The level of human suffering in our country remains high as the rich continue to receive bailouts and tax cuts.

Even if financial independence (FI) is not your goal. The sheer amount of people living their daily lives without a sufficient financial education is enough to make this website exist. If I can help at least one other person to swim rather than sink, then this whole endeavor is worth it. Don’t worry, finance – much as life, is not always doom and gloom. We all go through periods of scarcity and abundance in our lifetimes. It’s how we react to and manage each that will determine financial success.

It may come as a surprise but to declutter finances and in turn, get a grip on your financial life, you need to do what it takes. This includes being willing to give up what is not actually benefiting you, things like constantly drinking at the bar, paying for memberships you only use once or twice, or even all the Scooter runs. Yes, I said it. It’s bad for your teeth (AKA your money makers) so why even consume it?

And honestly, if we can’t do what it takes to help ourselves, where does that put us?

For some, decluttering finances can be a wake-up call they need to start respecting themselves. Who would keep a friend that continually mooches from them and never gives back what they take? Because if you’re constantly stressed about your finances yet still purchase whatever you want whenever you want it, you’re mooching off your future.

Do better!

The first step is easy. I want you to take a blank sheet of paper and draw a line down the middle. You need to list all your monthly income on one side. If it varies from month to month, take an average of the last three months (month 1 + month 2 + month 3)/3. Now list all your expenses in the other column. I don’t care if you have to open credit card statements or add things up, list everything. You might be surprised how long or quick it takes. It just depends on how much of a handle you already have on your spending.

Done? Great!

Now beside each expense list if it is a want or a need. If you’re unsure then it’s 99.99% (AKA 100%) likely a want. Wants are things you can live without, nobody truly needs them. Needs are things that we should have like housing, utilities, and food. Depending on where you live, cars are not a need but should you be rural and need the vehicle to make money, you must address if your car is the right one for you. Don’t fall into the trap of “new and shiny is best” thinking the majority of Americans do.

I want you to add up all your “need” expenses. How much does it come out to? Is your total monthly income enough to cover all of your monthly needs? It ideally should be! Needs should not take up more than half of your total income.

If they do, then you need to assess why.

Is it because you chose to live in a part of town you can’t actually afford? Or maybe it’s because you haven’t applied yourself to seeking a better-paying job. Remember again, you must do what’s best for you. If you are capped in income because of education or location, look at your options. Would a certificate or trade pay better? Can you find housing 20-30 minutes further that is more affordable or are you willing to move somewhere rent is comparable but jobs in general pay better? Maybe move to the golden duo, lower rent, and higher pay! They exist. I’ve lived in those areas.

Add up all your wants, this is typically where people fall short and spend egregiously.

How much is left over? Nothing? Are you saving anything at all?

It wasn’t so long ago that America was filled with savers. Our grandparents, the Silent generation, had a savings rate of 20%+. My grandma always saved, maybe not with an investment mindset but when she passed she left over $100,000 to be distributed to her sons. When moving dressers inherited from her, I’d found $800 cash in the drawer linings. If she could do all that with wages they earned back in the day, we can too.

It’s time we make a choice.

Once you’ve cut expenses and determined your income, you need a new sheet. Divide it again down the middle and list your income on one side. Now rebuild your budget focusing on needs. Once all your needs are listed, is there money left for a few wants? The thing Americans struggle the most with is learning to be content with what they have and knowing when enough is enough.

You must determine what wants you get to keep. For example, I want a subscription to Kindle Unlimited at all times because I’m a heavy reader. It saves me so much money on books. I’d like a premium subscription to Spotify to avoid ads but it won’t kill me not to have it. A premium subscription to Spotify does not provide me a financial benefit as I can still listen to everything I want, just after ads.

For my Kindle Unlimited subscription, I purchase multiple months in bulk around the holidays and add it to my time, saving me additional money and incurring only a one-time cost annually or bi-annually. For Spotify, I wait for their offers and can typically pick up 3 months for $1 then cancel the subscription. $1 in the grand scheme won’t hurt me but multiple $1 subscriptions can and will have a long-term impact.

Choose expenses in your new budget wisely.

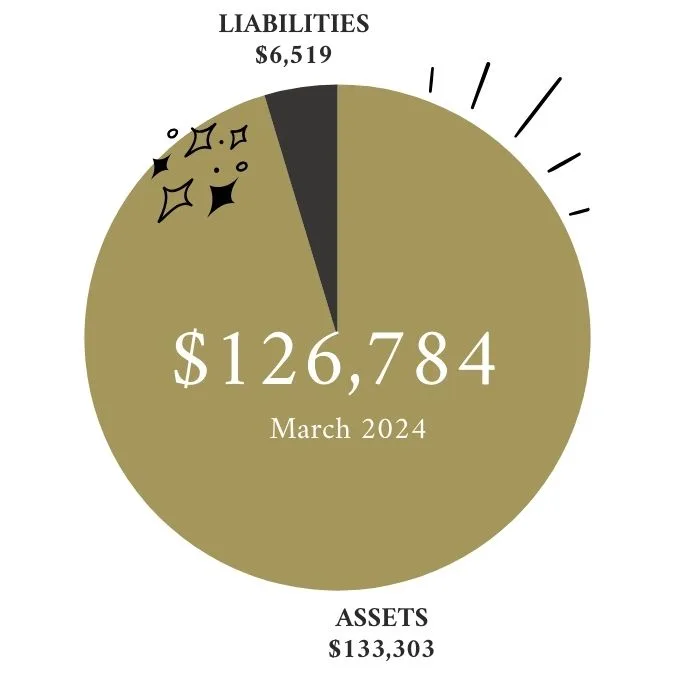

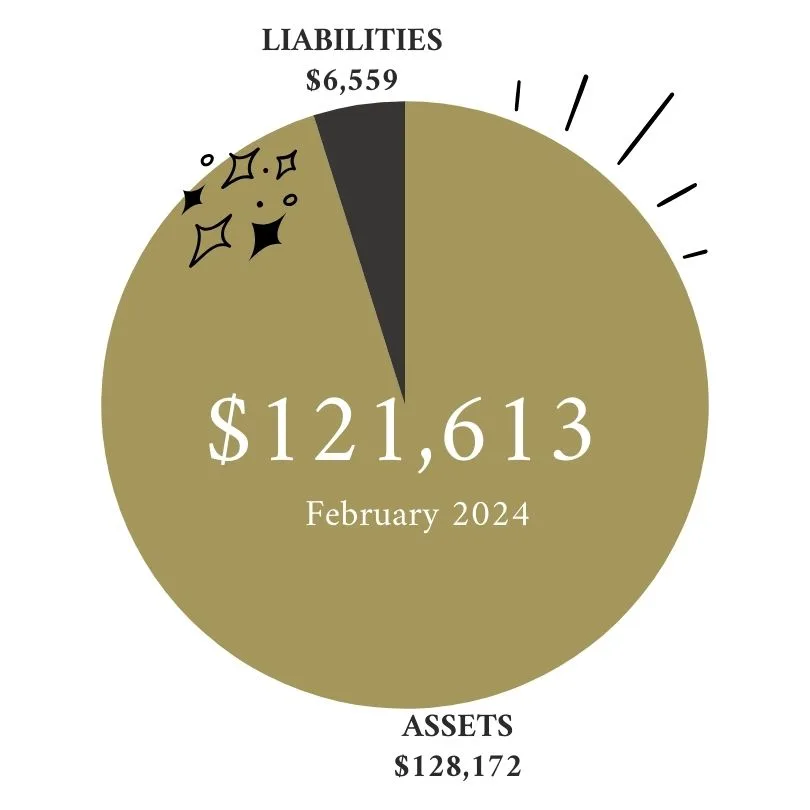

The second step requires – you guessed it – another blank piece of paper. Draw a line down the middle and list all of your asset accounts on one side: savings, checking, CDs, brokerage, 401k/403b, IRA, FSA/HSA, etc. Now think about the possibility that you left anything out, maybe an old retirement account you lost track of?

Once you’re confident everything is listed, include the amounts next to them. Add them up, how much do you actually have to your name? Now analyze and consider if you need any of the accounts or if they could be merged. An easy trap to fall into is creating accounts just for the welcome gift or bonus money. Determine if you have too many and the steps that need to be taken to consolidate them. Don’t forget to consider applicable tax implications!

Next list your total debt accounts. Do you have any debt? As a millennial, we are more likely to hold student loans and credit card debt. Is your debt manageable? The monthly payments should have been included in your new budget. If they weren’t, you need to restructure it.

Part of building a budget and investing is to help eliminate debt. We must hedge the rate of return on investments against interest rates on the debt we’ve already accumulated. For example, the REITs I’m invested in cover the monthly payments for the small number of student loans I accumulated. Because my student loan interest rate is only around 7.25% and REITs bring in over 10% annual dividends, I choose not to pay off my student loans faster than the arranged schedule. Money is worth more now than in the future after all! Investing the money I would have spent to pay off the loans means I can keep it invested while using the dividends to pay it down. Do not copy this strategy unless you’re aware of all risks and liabilities, tax, or otherwise.

Debt: $6700 approximate in student loans = $80/monthly payment

Invested: $6700 * 15% dividend = $1,005/year or $83.75/month

The risk is possibly losing the full $6700 in a market bust or if the REIT goes under. This is why I always stress to only invest at the risk level you’re willing to accept.

Create an action plan to increase your monthly savings rate and decrease debt, if any. Your future self will be thanking you in no time! Think you have a new budget and strategy? Let it play out for 3 months and then complete the process again, honing your budget and strategy over time. You’ll be on the road to financial independence before you know it.